The National Treasury states that roughly 6% of South Africans are on track to retire comfortably. Are you one of them? You may be thinking “I’m too old to start now”, or “I can’t afford to plan for my retirement right now.” Well think again! It’s never too late to start thinking of your future, and any contribution will make a difference in the long run.

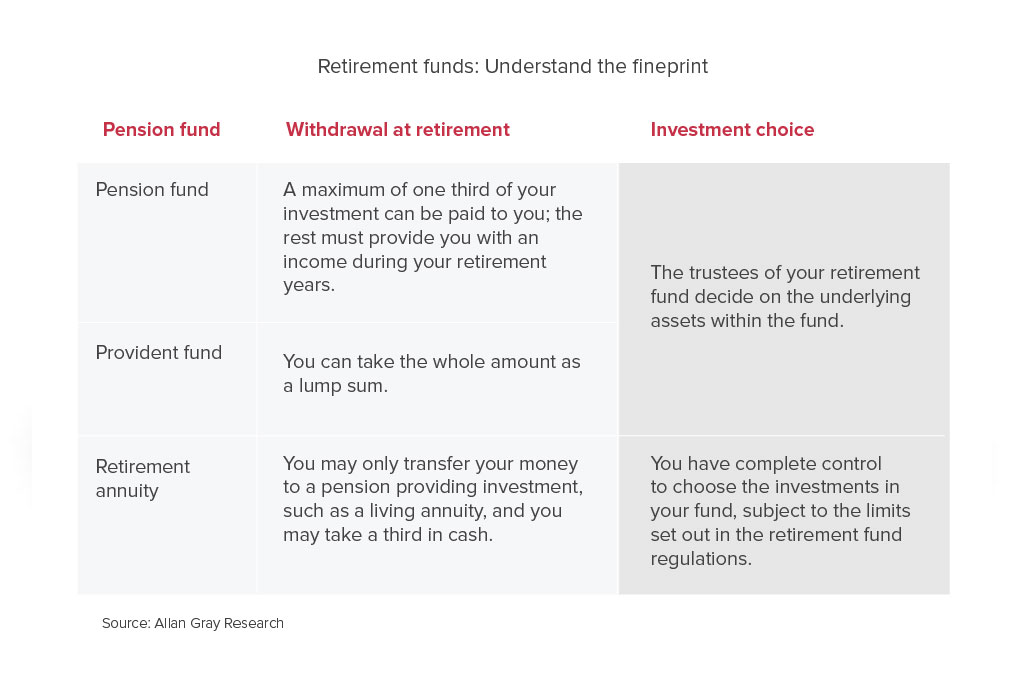

There's more than one way to save for your retirement. The traditional pension fund isn’t the only way to go about it. Even though it may be the most well known option to save for your future, it’s important to look at all your options before making the choice, if you haven’t already. So, what are the differences between a pension fund, provident fund and a retirement annuity? And which one will suit you best?

Pension fund

This one usually comes with a job. You join a pension fund through the company that employs you. Your money is managed by the trustees of the fund who decide which assets to include and exclude. When you retire, you may take up to a maximum of one third of your savings in a cash lump sum which is taxable. The balance must be used to purchase an income/annuity, which is also taxable. If you leave the company before retirement age, you may have to move your savings out of the company fund, either to your new company’s fund, to a preservation fund or retirement annuity fund or you can opt to take a cash payout.

Pension funds are tax deductible to a certain degree.

Provident fund

The provident fund differs from the pension fund in that you can withdraw the entire savings amount as a lump sum when you retire. However, the Government is looking to align the benefits of provident funds to those of pension and retirement annuity funds. This means that provident funds will ultimately be essentially identical to pension funds. The result is that you will only be able to withdraw, as with pension funds and RA’s, a third of your provident fund savings as a lump sum upon retirement, while the rest has to be invested in an income/annuity fund that pays you a monthly income. This legislation has not been applied and has been postponed until 1 March 2021.

Retirement Annuity (RA)

With this option you also make monthly contributions, usually via debit order, but this is completely independent from your employer. You can choose what funds you invest this money in (within the limits set out by the retirement fund regulations). When you retire, at age 55 (minimum) or older, you’re allowed to take a maximum of one third as a cash lump sum (taxable) and the balance must be used to purchase an income/annuity. If you leave your job, it makes no difference to your RA. It just continues as it is not linked to your employer.

The contributions to your RA are tax deductible.

With all three of these options the growth and income within your fund while you are a member of the fund is tax free. Tax is only payable when you access your funds as discussed above.

Why should I save for retirement?

What happens to you when you have absolutely no source of income and no savings to help you out? At the moment the pensioner grant in South Africa is roughly R1700 per month. This is less than the average person usually spends on groceries, car payments, etc. Could you live on that? Some of us don’t have family and children who can and will look after us when we’re old and frail. So the onus rests on you. While retirement may seem like a goal too far in the future to affect you if you are under 30, or you may feel like you have missed the boat if you are over 40, it’s never too early or too late to start thinking about your future.

So, when do I start?

As with most financial commitments or investments, it’s best to start as soon as possible. Getting started early will offer great rewards as the compound interest on your retirement savings really starts working for you over time. The longer you are in the market, the potential there is for growth for your capital.

The retirement age has increased over the years, with many people opting to work a few more years in order to save some more before retiring. You don’t necessarily have to continue with your 9 to 5, part-time work or anything generating an income can greatly increase your pay-out when you do decide to leave the workforce completely. And, it's been said that working helps keep your brain active and can slow the ageing process.

But I don’t have a lot of money to put away.

If you think it’s true, then it must be true. Confronting your mental barriers to saving for retirement is your first (and most difficult) investment. Most of us don’t have a big lump sum to invest in one go, but putting away smaller amounts regularly can be just as effective. It can be overwhelming trying to figure out your retirement strategy but speaking to a financial adviser can help you figure out exactly how much you can afford to put away every month. They will be able to outline various options and solutions.

You can also assess your current lifestyle and cut back on some expenses now, so that you can reap the rewards later. You can start with as little as R500 per month by giving up a pair of shoes, one fancy dinner or even your daily coffee habit. It’s also a good idea to get rid of any debt in the form of personal loans, credit cards and store cards so that you can put this money towards your retirement savings.

Okay, but how do I start saving for retirement?

Step 1 - Assess your spending habits, as mentioned above, and determine the minimum amount you will be able to put towards your retirement every month.

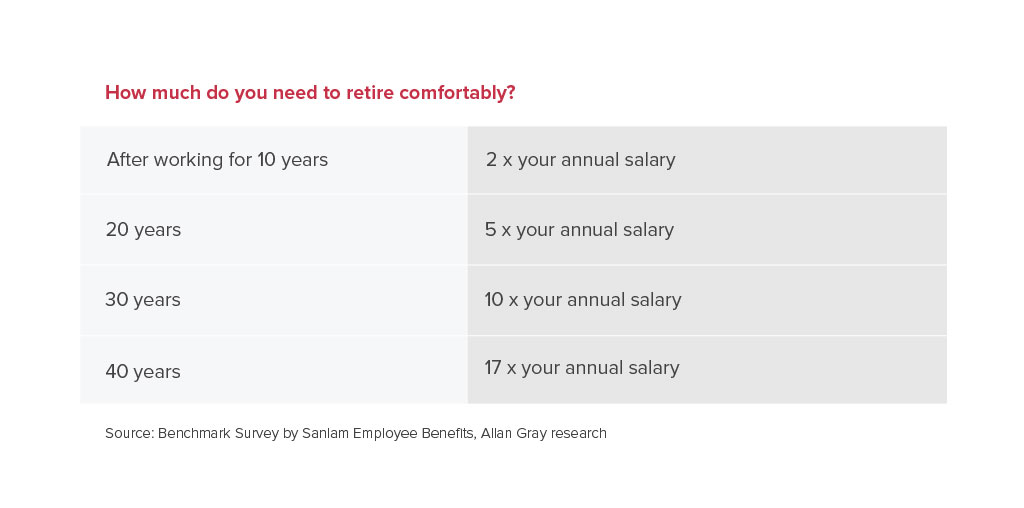

Step 2 - Calculate how much your will need to save each month. You need to have saved twice your annual salary after working for 10 years, five times your annual salary after working for 20 years and 17 times your annual salary after working for 40 years. And then consider how long you have until you retire – this will influence how much you need to save each month to meet your targets.

Step 3 - Find the right fit. Take the time to research investment managers and what they offer.

Step 4 - Do it now! Each month that you put off saving in favour of spending either increases the amount that you’ll have to save in the remaining months, or pushes out the date at which you’ll reach your goal.

How much do I need to save?

According to experts at Allan Gray you should aim for a retirement income of 75% of your final salary. Assuming that you will be comfortable with this amount, their research indicates that saving 17% of your salary is a reasonable starting point for the 25-year old saver. It’s important to note that this amount increases dramatically the later you start - You’ll need to save 22% if you start saving at 30, up to 42% if you start at 40, and up to 59% if you start at 45. Which just highlights the importance of starting as soon as possible.

There are many ways to invest for retirement. Each option has its benefits but the key is that saving something for retirement is important. There are other options for retirement savings which include investing in property, playing the stock market or purchasing, investing or reinvesting different types of annuities. All have pros and cons and we suggest you talk to your financial adviser for the best options for you.

Are you well on your way to saving for retirement? What did or are you doing to plan for your future? Join our members group on Facebook and share your tips or stories with us. We can’t wait to hear from you!

The above should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.

***

Please remember that it is up to each one of us to do our part and keep ourselves and loved ones safe. Visit https://sacoronavirus.co.za/ for more information about the current pandemic.

At bsmart we help our members save, and pay out cash-back bonuses every three months or annually. To learn more about bsmart contact us or click here to sign up directly through our website.